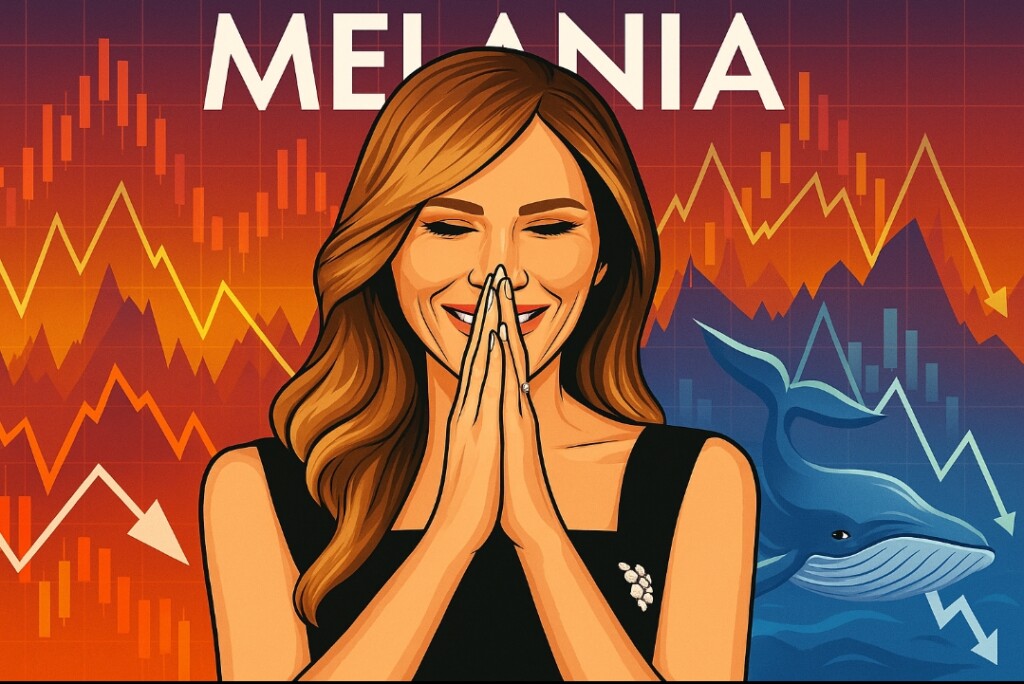

The MELANIA memecoin project is under increasing investor scrutiny and concern. Why? Because it’s now known that the team behind this token has sold more than 8 percent of the total supply, dragging tens of millions of dollars out of the project in the process.

Over the past four months, on-chain analysts have examined the situation and come to a not-so-flattering conclusion: We’re dealing with a liquidation strategy that’s largely worked out in private. Oh, and the lack of transparency is renewed fuel for long-standing memecoin sustainability concerns.

Although the MELANIA token took off partially because of its association with the First Lady, recent events have cast doubt on its legitimacy. MELANIA is now very much in a “prove it or lose it” mode, with its holders left wondering what, if anything, the project has planned beyond the current meme-driven market and whether it actually has a path toward becoming that much-ballyhooed “real utility” player.

Over 82 million tokens sold via liquidity maneuvers

The MELANIA team has sold nearly 82.18 million MELANIA tokens in the last four months, according to blockchain data. Those tokens represent about 8.22% of the total circulating supply. They’ve been sold, though, in a manner that’s pretty difficult for the average crypto space watchdog to detect. Instead of just exchanging the tokens for crypto or cash and, you know, cashing out, the MELANIA team has employed a strategy that maintains a bit more silence and a lot more plausible deniability.

In total, the team used 44 different wallets to dissipate and disguise their selling activity. And instead of making large, easily traceable transactions, they deposited tokens into liquidity pools, then withdrew them after enough counterparties had bought in. This allowed them to exit positions without triggering the kind of immediate panic that might ensue if a lot of tokens suddenly appeared on the market.

A total of 244,934 SOL netted in sales, currently worth around $35.7 million. The offloading effort with this large scale, combined with its under-the-radar execution, is hitting the MELANIA community and beyond like an earthquake. Many investors who were not aware of the team’s selling were riding through price drops under the assumption that the insiders were still in the project and committed to seeing it through.

$MELANIA Team Selling Alert

Over the past 4 months, the Melania #Memecoin team has sold 82.18 million #MELANIA — that's 8.22% of the total supply 😳

They used 44 different wallets and cashed out 244,934 $SOL — worth around $35.7 million.

Most of the selling was done quietly by… pic.twitter.com/0arQOPOVb0

— Crypto Patel (@CryptoPatel) June 25, 2025

Price collapse and transparency questions

The market has felt the impact of the sell-off closely. Over the last 60 days, MELANIA has dropped 59% from its local high. Although some price corrections in the memecoin sector, which is part of the broader crypto market, were expected after explosive Q1 growth, the severity of MELANIA’s decline seems now to be because of stuff happening inside that project, rather than being pushed down by outside forces.

The MELANIA team hasn’t communicated at all. So many good projects lead the community (and often their investors, too) along a clear path, with regular updates, to the point where the project’s vision becomes a reality. What makes the MELANIA situation awkward is that it fails to check any of these vital boxes even as it offloads (presumably to pay for all of these fancy launch parties) tons of tokens.

Even the Wintermute partnership, once seen as a legitimizing move for the project, has not reassured holders. While market-making firms can help with liquidity, they do not guarantee long-term project viability. And as more wallets with MELANIA team members have been identified, the pressure is mounting for the project’s creators to come forward and offer popular transparency about their actions and intentions.

What comes next for MELANIA holders?

For investors who are still holding MELANIA, the way forward is unclear. On the one hand, the meme coin market has consistently shown its ability to do the unexpected and come back from major sell-offs. On the other hand, the recent news concerning team dumping has set the token’s credibility back significantly (think the opposite of a solid rebound). That’s not just bad for current holders, either; future growth for MELANIA seems to rely even more on community trust and project development (which recently walked in the opposite direction).

Now, analysts from the blockchain are urging holders to keep a careful watch over the wallets connected to the team. If the current pattern of slowly siphoning off liquidity from the market continues, it will almost surely lead to further price declines.

At present, MELANIA is merely a cautionary tale in the speculative crypto landscape. It reminds us that even highly publicized tokens with the backing of a famous person and the heft of major market makers are not necessarily well run, or run for the benefit of their investors.

Conclusion

A team of people associated with MELANIA appears to have quietly offloaded more than 8% of MELANIA’s supplies—worth about $35 million—in the recent past. There is no apparent reason for this offloading when it was done, and there is no public indication of what is supposed to be happening with the project. Public offloading of that scale—and with those optics—is not something that instills confidence in the project’s future or in the team behind the project.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

No Comments