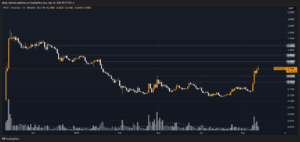

Last month was less volatile compared to this month’s recovery, which led the bulls back on track after three months of wide correction. The trading landscape changed, and the bulls regained control of the market.

PNUT didn’t see much recovery last month after taking off from a low of $0.12. However, it posted gains and tapped a high of $0.19, though it later lost buzz after marking the high as resistance in the late month.

Pulling slightly off this high, it later picked up following a new money inflow in the market last week, and it rallied hard to its highest level in three months. It closed strongly bullish despite facing a slight rejection.

Following another major increase today, it appeared more bullish on the daily chart as it pushed higher. However, the buying pressure is reaching an exhaustion point due to consistent candle wicks in the last three days.

These candle wicks indicate a rejection, and from the look of things, the price will likely drop shortly. If that comes into play, it may pull back below the $0.3 level before rising back.

Should in case the volume continue to flow into the market to sustain the buying pressure on the daily chart, we can expect more highs to surface until the momentum fades. Currently, the bulls are still in charge despite the latest rejection.

PNUT’s Key Levels To Watch

Pushing above the daily high could allow more buying to the $0.6 level. Higher resistance levels to keep in mind for tests are $0.8 and $1.22 in case of a more pressure.

But looking at the latest price actions, PNUT’s bulls appear weak. If they lose control, the price may slide to a nearby support of $0.31 for a buyback. Lower support levels to consider for a drop are $0.24 and $0.2.

Key Resistance Levels: $0.6, $0.8, $1.22

Key Support Levels: $0.31, $0.24, $0.20

- Spot Price: $0.43

- Trend: Bullish

- Volatility: High

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

No Comments