Tokenomics isn’t a buzzword. It’s the blueprint for every crypto project. Nail it, and tokens gain real value. Mess it up, and retail investors become the exit liquidity.

So, Tokenomics fuses “token” and “economics.” It covers supply mechanics, distribution models, utility, vesting, and incentives. Then, It shows how tokens enter the market. It shapes demand. So, it dictates who holds power. Understanding tokenomics helps you back winners, not exit victims.

Key Components of Tokenomics

- Token Supply

Total tokens in existence. It sets the stage for inflation, deflation, and valuation.

- Token Distribution

Who gets tokens and when. It defines power dynamics between insiders and the community.

- Token Utility

Real use cases. Good utility drives scarcity and demand.

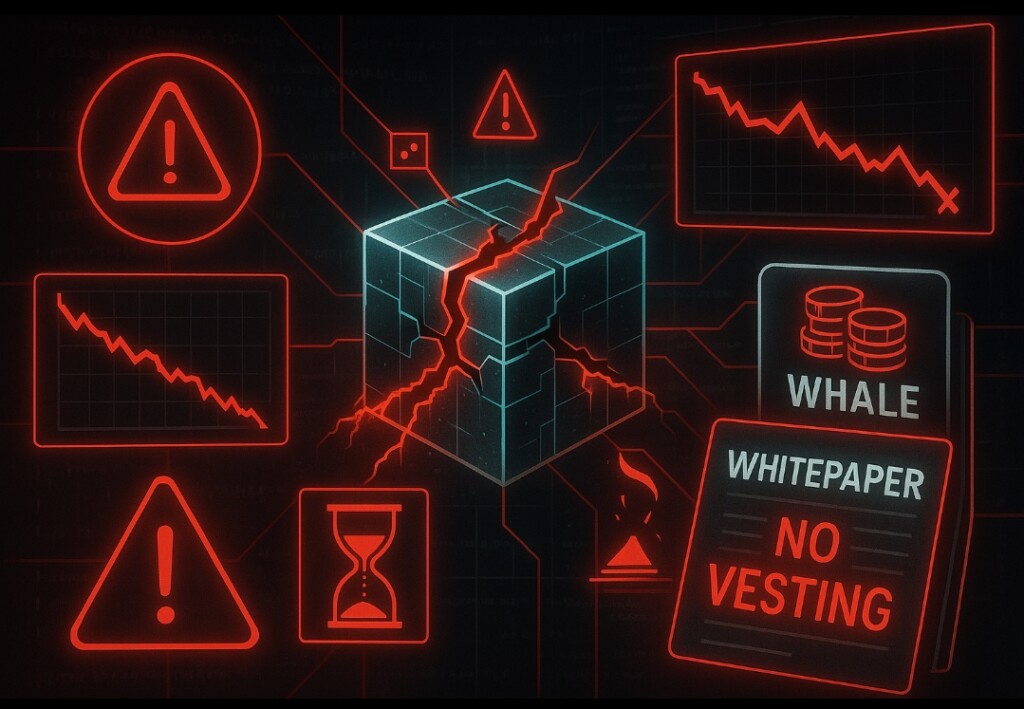

5 Red Flags in Tokenomics

1. Excessive Supply without Purpose

Imagine a token with 1 000 000 000 000 total supply and zero utility. Circulating supply sits at 10 000 000, price tags at $0.00005, market cap just $500 000 (CoinMarketCap). Projects do this to make their token look cheap. Retail buys in. Insiders hold 99%. They dump. You hold the bag.

2. Lightning‑Fast Unlock Schedules

Token launches. Day 0, devs unlock 20 %. Day 1, investors unlock 15 %. Two weeks later, 70 % of non‑circulating supply floods exchanges. Fast unlock means fast dump. You buy at launch. They exit at peaks. Healthy vesting waits: cliffs of 3–6 months, linear unlock over 12–36 months, full on‑chain transparency.

3. Promises Only in Whitepaper, Not in Code

Whitepaper says “team tokens lock for 12 months.” Smart contract shows no vesting. Or worse—it lets the team move tokens anytime. Without on‑chain vesting contracts, you rely on trust alone. In crypto, trust without code equals risk. Always verify vesting logic on Etherscan or BSCScan.

4. Whale‑Heavy Distribution

You scan holders. Wallet A holds 30 %. Wallet B holds 25 %. Ten wallets control 75 % of supply. That’s concentration, not decentralization. A single whale can crash price with one sell order. Retail gets stuck cleaning up the mess. Look for top 10 wallets holding under 40 %.

5. Over‑The‑Top Rewards without Revenue

“Stake for 1 000 % APY.” “Join our airdrop for free tokens daily.” High yields lure eyes. But where do rewards come from? If it’s endless token emissions, supply inflates. Selling pressure mounts. Price collapses. Sustainable rewards tie to real revenue—protocol fees, trading commissions, actual cash flow.

Conclusion

Tokenomics reveals intentions. It shows whether a team aligns with long‑term holders or chases quick flips. Red flags, huge supply, rapid unlocks, off‑chain promises, whale‑heavy distribution, and sky‑high APYs, hint at manipulation.

Before you commit funds, do this:

- Read total supply and circulating supply on CoinMarketCap.

- Check vesting schedules in smart contracts.

- Audit token distribution on block explorers.

- Scrutinize reward models for real revenue.

In crypto, insight trumps impulse. Study tokenomics like your portfolio depends on it, because it does.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

No Comments